To receive your international package, you will need to settle any applicable GST and/or Duty beforehand. You can make the payment through the SingPost app, at POPDrop or by visiting any post office. Once payment is confirmed, your package will be delivered.

- Go to https://mysam.singpost.com and register for an account

- Make payment within 14 days from the date of notification.

- You may watch this video-guide on how to make payment via Mysam

- Once payment is received, item(s) will be delivered within 2-3 working days.

Online payment via Mysam

- Download the SingPost app from the App Store / Google Play Store, and register for an account. You will receive notifications on payable items.

- Make payment within 14 days from the date of notification.

- You may watch this video-guide on how to make payment via the SingPost app.

- Once payment is received, item(s) will be delivered within 2-3 working days.

SingPost Mobile App

- All GST and/or Duty payable amounts are to be paid in full before SingPost can release the item for delivery.

- To verify the authenticity of your shipment, customers should view the tracking status of the item using the Tracking Number provided.

- Customers without a registered account on SingPost App will be notified via email/letter.

- If payment is not made by the due date, SingPost will return the item(s) to the sender.

- If duty and/or GST has been paid via Customs permit, please send the payment details via email to oclgst@singpost.com.

- For more information, please refer to our FAQ below.

Frequently Asked Questions (FAQs)

If you are importing goods by post or Speedpost services, these parcels will be processed and managed by SingPost. If you are importing goods under vPost, they will also be processed and managed by SingPost. As such, SingPost may contact you about these parcels or items if we have any queries.

Your item is on hold pending your payment of Goods and Services Tax (GST) and/or duty. Please note that your postal parcel may be held by ICA/SingPost for the following reasons:

- the postal parcel contains dutiable goods;

- the postal parcel contains controlled goods;

- the postal parcel contains prohibited goods; and/or

- the postal parcel contains goods of a total CIF value exceeding S$400 and does not have an invoice attached to it at the time of arrival.

In the event that your postal parcel has been held by ICA/SingPost, you will receive a notification letter from SingPost which will advise you on the follow-up action required.

SingPost will notify you once the GST and/or Duties have been computed. You will receive notification via:

- SingPost Mobile App: A push notification (for registered users).

- SMS / Email: If your contact details had been provided by the sender.

- Notification Letter: A physical letter sent to your delivery address if no digital contact info is available.

You must make payment within 14 days of the notification date. If no action is taken, the item will be returned to the sender.

Kindly note: If your tracking status shows "On Hold" but you have not received any notification or letter after 3 working days, please contact us.

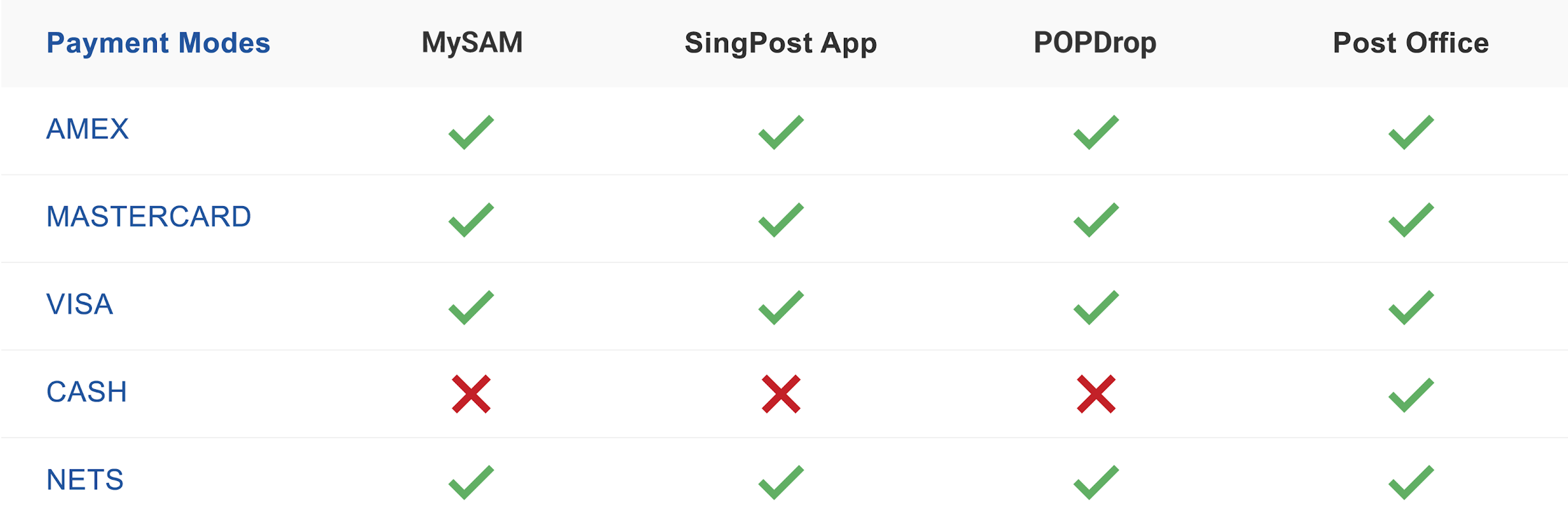

You can pay using your Tracking Number via these channels:

- SingPost Mobile App: The fastest way to receive push notifications and pay directly from your phone.

- SAM Online: Visit mysam.singpost.com to pay on-the-go via your web browser.

- POPDrop kiosks: Select "Pay Bills" on the kiosk screen.

- Post Office counters: Visit any outlet to make cash or cashless payments such as NETS and credit cards.

Please note that there may be fees imposed by SingPost, such as Handling Fees and Administrative Fees, that are payable by the recipient.

Once payment is confirmed, your item will typically be delivered within the next 2-3 working days.

As a Service Provider, SingPost charges a flat rate of $10.90 per consignment to act on your (recipient) behalf for the collection of GST or relevant duties to Singapore Customs. Recipients to pay the Handling Fee alongside the applicable GST and/or duty. The Handling Fee is non-refundable.

For goods arriving into Singapore without its commercial invoice attached, SingPost will impose an additional flat fee of $10.90 as Administrative Fee for our services rendered to enable the smooth processing of parcel imports with the relevant parties. Recipients to pay the Admin Fee alongside the applicable GST and/or duty. The Admin Fee is non-refundable.

Once you have received the notification, you can proceed to make your payment(s) via the SingPost Mobile App, SAM Online, POPDrop kiosks and at all post offices. Quote your Tracking number for all payment modes.

If you have imported via ordinary mail or Speedpost and overpaid GST, for example due to various reasons including incorrectly declared values or short shipped items, etc, you may apply for a refund through SingPost.[what is the SingPost process?]

Your refund claim should be supported by the following supporting documents (where applicable):

- Copy of GST/duty payment receipt

- Commercial invoice

- Consignment/dispatch note for the imported goods

- Export and refund document for returned faulty goods (for example, shipment advice, seller’s credit note, etc)

- Documentary evidence showing that the money paid for the returned goods was credited back to the buyer

- Any other documents to support the claim for refund (for example, Customs In-Non-Payment (GST Relief) permit, etc)

All goods imported into Singapore are subject to Goods and Services Tax (GST) at the prevailing rate. It is calculated based on:

- Customs value of the goods, plus all duties, or

- Value of the last selling price plus all duties, if there has been more than one sale (when the last buyer is the party declaring the payment permit)

For all goods arriving into Singapore, the overseas sender must attach the invoice or confirmation slip (with the value of goods indicated) or Postal Convention Note (with the value of goods indicated) to the exterior of the postal parcel for the computation of GST and/or duty payable.

Kindly note that it is not permissible for a postal parcel consigned to the same recipient (importer) and arriving in Singapore on the same flight to be split into separate packages for tax assessment purposes.

GST is computed based on the Cost, Insurance, and Freight (CIF) value of the goods, plus any customs duties payable. Postage charges are considered part of the freight and insurance costs.

Goods imported by air or post, excluding intoxicating liquors and tobacco, may qualify for import GST relief if the CIF value does not exceed $400. If the CIF value is above $400, GST will be applied to the full value of the goods. All prices stated are in Singapore Dollars.

Goods that are imported into Singapore by parcel post through ordinary mail or Speedpost (e.g. for goods that are purchased online) are subject to GST. This applies to all new articles, personal articles, souvenirs, gifts, food preparations and dutiable products.

All dutiable goods imported into or manufactured in Singapore are subject to customs duty and/or excise duty. Customs duty is duty levied on goods imported into Singapore, excluding excise duty. Excise duty is duty levied on goods manufactured in, or imported into, Singapore.

The duties are based on ad valorem or specific rates. Please note that there are 4 categories of dutiable goods:

- Intoxicating liquors

- Tobacco products

- Motor vehicles

- Petroleum products and biodiesel blends

For specific duty rates, please refer to the list of dutiable goods at

Your items are on hold until payment for GST and/or duty has been received. If you fail to pay the applicable GST and/or duty within 14 calendar days from the date of notification, the items will be returned to the sender.

You will be notified via the SingPost app, email, or letter to make the necessary payment within 14 days of the date of notification. Your items will be delivered within 2 to 3 working days when SingPost receives your payment of the applicable GST and/or duties.

Please note that the counter service for self-collection of dutiable goods closed in 2021.

This is due to the updated process implemented by Singapore Customs, Immigration & Checkpoints Authority (ICA) and SingPost for the collection of GST and/or duty for parcel imports. In this updated process:

- SingPost will be collecting the duty and/or GST for parcel imports from recipients, on behalf of Singapore Customs.

- All dutiable SpeedPost items will be delivered once the necessary documents and payments are received.

- All duty and GST will have to be paid in full prior to delivery.

- All imported goods will continue to be subjected to examination by ICA.

When your dutiable items arrive in Singapore, you will be informed through a notification via your SingPost App, email, letter, or SMS. The mode of contact is based on the information stated on the parcel's attached commercial invoice.

If there is no commercial invoice attached, recipients will receive a Notification Letter from SingPost requesting the relevant documents. Kindly note that an Administrative Fee of $10.90 will be imposed by SingPost for the additional services rendered to process your parcel.

To prevent delivery delays and to facilitate smooth processing by SingPost, recipients should arrange with the senders to attach the invoices to the parcels for the computation of applicable GST and/or duty. You can also email the invoice to SingPost at g-dps@singpost.com.

Once all information required to process your delivery is available and payment is received, SingPost will deliver the parcel to you within 2 to 3 working days.

SingPost does not participate in the Tourist Refund Scheme (TRS) and will not be able to process any GST refunds.

The TRS scheme allows tourists to claim a refund of the GST paid on goods purchased from participating retailers in Singapore if the goods are brought out of Singapore via Changi International Airport or Seletar Airport only. Details about the TRS is available at https://www.visitsingapore.com/travel-tips/essential-travel-information/gst-tax-refund-singapore/

Please note the following:

- Singapore Customs does NOT collect clearance fees for the clearance of goods in Singapore

- Singapore Customs authorises SingPost to collect the payment of applicable GST and/or duty on the goods imported into Singapore.

- SingPost charges Handling Fee and/or Admin Fee for our services rendered in processing, tracking, and delivery of the goods.

- All payments to SingPost are via the SingPost Mobile App, SAM Online, POPDrop kiosks or any of our post offices.

Please do not click on any links in the message. If you suspect that you have been the victim of a scam, please lodge a police report.

The weighing of tobacco products (e.g. cigars/cheroots/cigarillos) is conducted by ICA and witnessed by SingPost at the Airmail Transit Centre. Prior to weighing, internal packaging such as plastic bags and bubble wrap will be removed. However, cigars with individual packaging such as outer bands and shrink wraps will not have such packaging removed for weighing to preserve the integrity and quality of the product.

Singapore Customs does not have the information on the status of parcels as the tracking and/or delivery of postal parcels is handled by SingPost.

A parcel by post may be detained if:

- It contains dutiable goods,

- It contains controlled goods,

- It contains prohibited goods, and/or

- The parcel contains goods of a total Cost, Insurance and Freight (CIF) value above S$400 and/or does not have an invoice attached to it at the time of arrival.

In the event that your parcel has been held, you will receive a push notification via the SingPost App or via Email/Letter (if your parcel contains an invoice), to request for payment for the duty and/or GST items indicated on the letter. Once payment is received, SingPost will arrange to deliver the parcel items to you within 2 to 3 working days.

In the event your parcel does not contain an invoice, you will receive a notification letter requesting for an invoice. Your parcel will only be delivered once the required documents are submitted, and payment(s) received. For more information on the import procedures for goods imported via postal or courier services, you may refer to Singapore Customs' website here.

If you do not receive any notification call or letter from SingPost, please contact SingPost directly.

In addition, from 1 July 2020, all cigarettes and other tobacco products imported into, sold, offered for sale or distributed in Singapore must comply with the new Standardised Packaging (SP) requirements. It is an offence to import cigarettes and other tobacco products with packaging or labelling that do not comply with the SP requirements, regardless of their intended use or purpose. If the parcels contain non-SP compliant packaging, they will be re-sealed and returned to the sender.

However, Singapore residents will still be able to import tobacco products from other countries for their personal use, by post, but only if these tobacco products are fully compliant with Singapore's SP regulations. For further information, please refer to HSA's website or contact Ministry of Health (MOH) through email at moh_info@moh.gov.sg.